How to trade post-company result with a US stock warrant before the opening of US stock market?

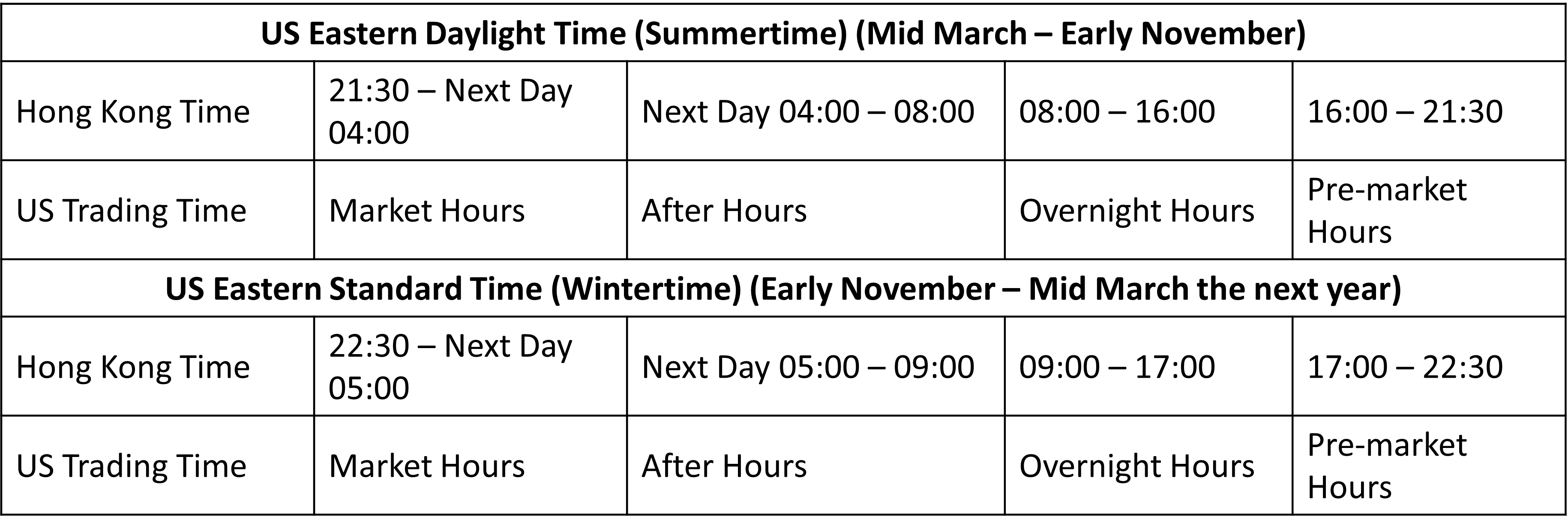

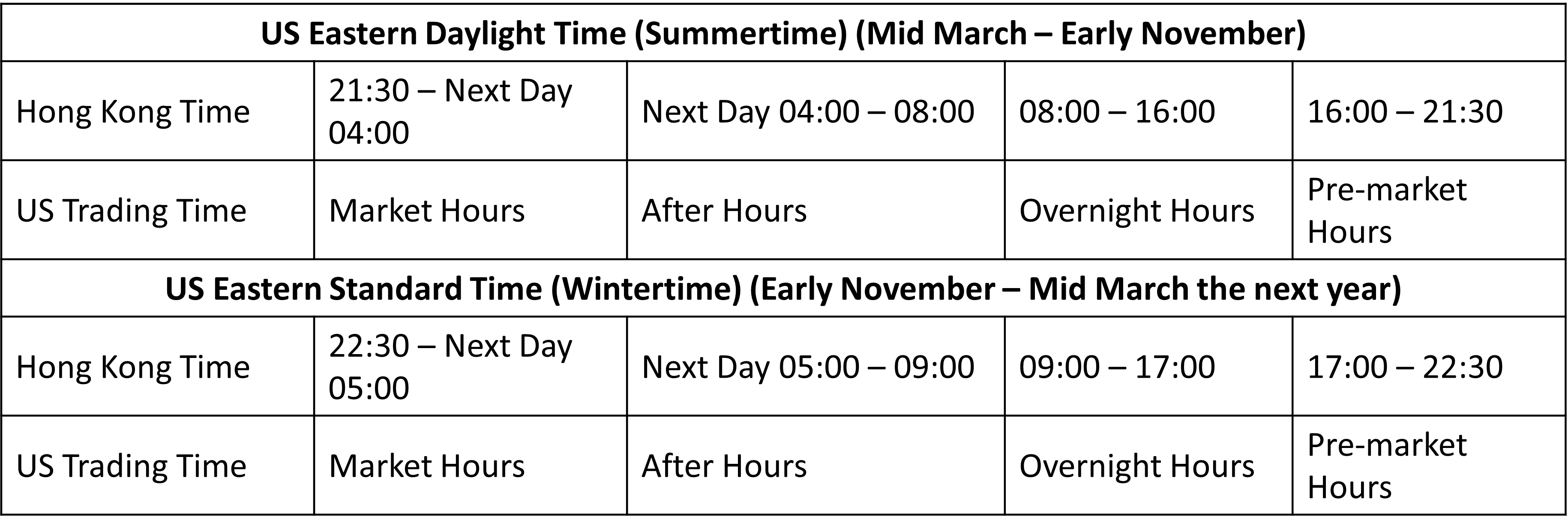

There are 4 trading sessions for US Stock market: (1) regular session, (2) after-hours session, (3) overnight session, and (4) pre-market session. See below:

US Stock warrants trading happens during Hong Kong trading sessions, which is during the US stock overnight session. Since the closing price of US stock may be different from its overnight performance, these prices are not comparable. When investors trade US stock warrants listed on HKEX, they should refer to the stock prices during Hong Kong trading hours. Investors can refer to SG warrants website "US Reference Price and Chart".

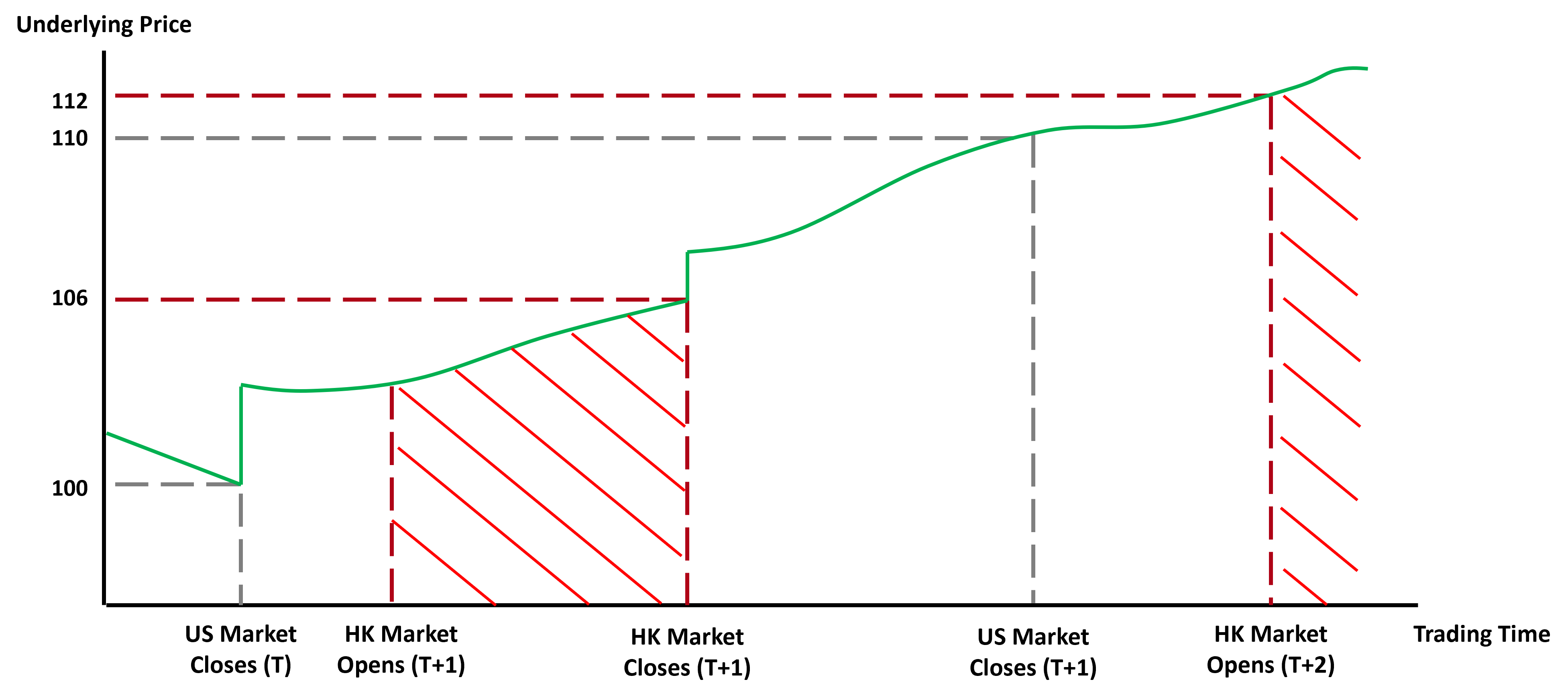

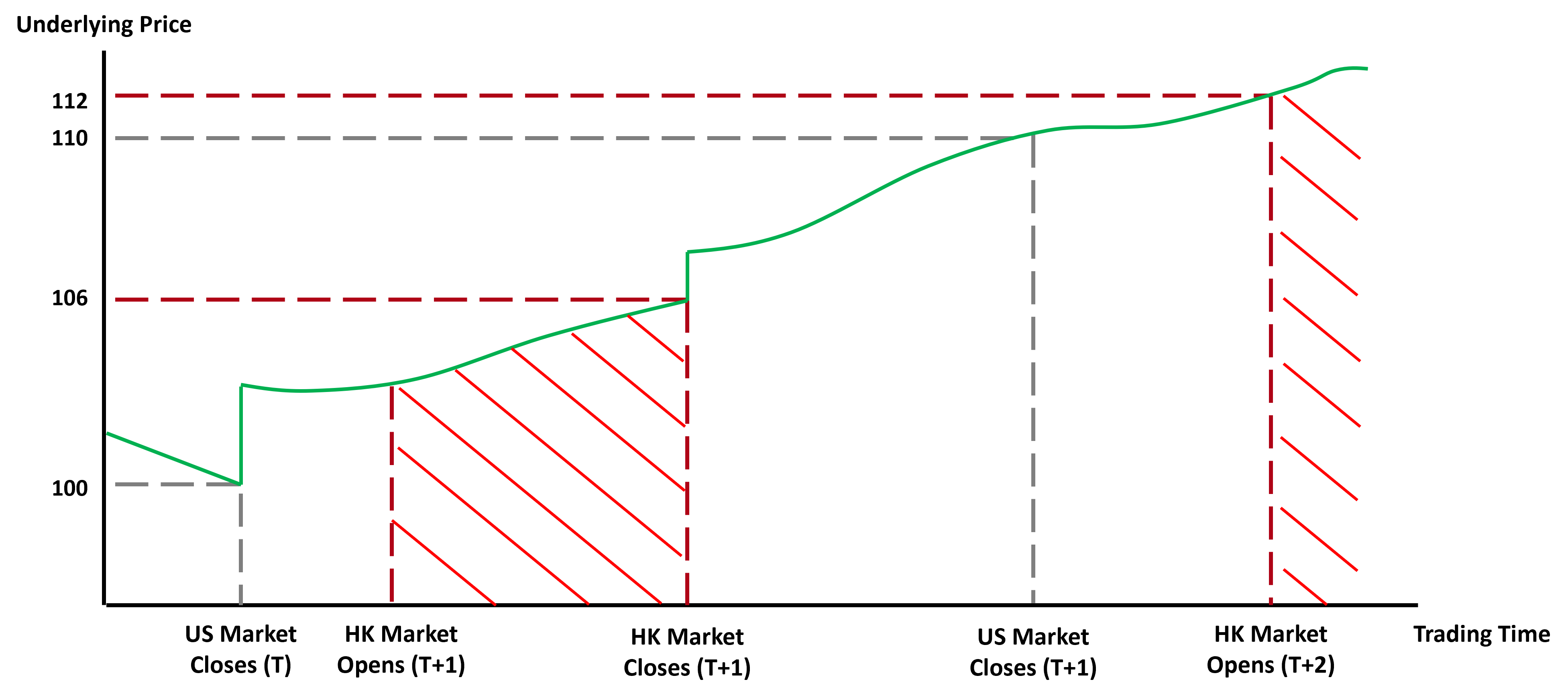

For example, if a US stock announces its earnings results that is better than estimates, driving up its share price from its closing of $100 and extending to Hong Kong trading session. If investors believe that the share price will continue to rise after the results, they can buy and hold the associated warrants until the next Hong Kong trading day. (See below illustration.)

If the US stock extends its rise during the next US regular session, closing at $110, and to $112 at the next Hong Kong market session, investors may take profit by selling the warrants at a higher-than-entry price, assuming the underlying price is the only factor affect the warrant price.

However, the day-on-day performance of the warrants are referred to the difference between the US stock price when it was at the close of previous Hong Kong session and the subsequent opening of Hong Kong session (brown line above: (112-106)/106 = 5.7% being correct), instead of the close price between two US regular sessions. (grey line above: (110-100)/100 = 10% which incorrect).

Therefore, if the US stock warrants chosen had a 5 times effective gearing for the above example, assuming other factors remain constant, the theoretical return of buying the call warrants should be 5.7%x5 = 28.5% instead of 50% (10%x5). Investors may mistakenly believe the warrants performance was not following the US stock’s performance if incorrect price was referred.