For US CBBC, how to calculate the Residual Value?

The US CBBCs issued by SG are all of Category R, which means there may be residual values after Mandatory Call Event (MCE) occurs. When the US underlying index spot price reaches the call price of the CBBC, mandatory call event will be triggered, and the residual value will be calculated after the end of the valuation period.

Formula of the residual value per board lot of the US CBBC:

US Index Bull:

Residual Value = (Lowest Spot Level – Strike Level) x board lot x currency rate / parity ratio

US Index Bear:

Residual value = (Strike Level – Highest spot level) x board lot x currency rate / parity ratio

The Exchange Rate refers to The rate of exchange between United States dollars (“US$” or “USD”) and Hong Kong dollars (“HK$”) (expressed as the number of units of HK$ per 1 unit of US$) at or about 4:00 p.m. New York time on the Last Valuation Date (one trade day prior to expiry) as determined by the Issuer by reference to the mid quote as per the rate “USDHKD” on Bloomberg page BFIX. If such screen rate is not available for any reasons at such time on such date, the Issuer shall determine the exchange rate in a commercially reasonable manner.

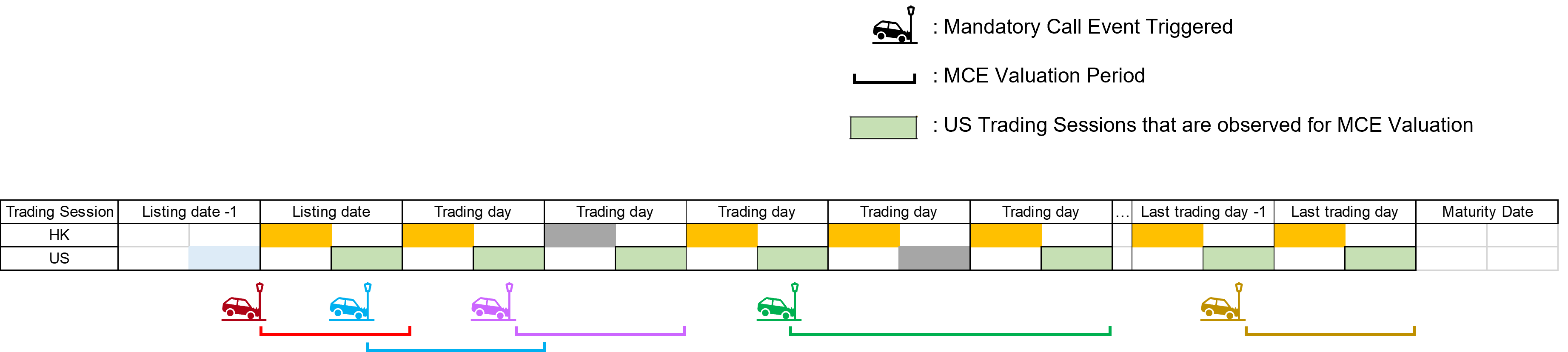

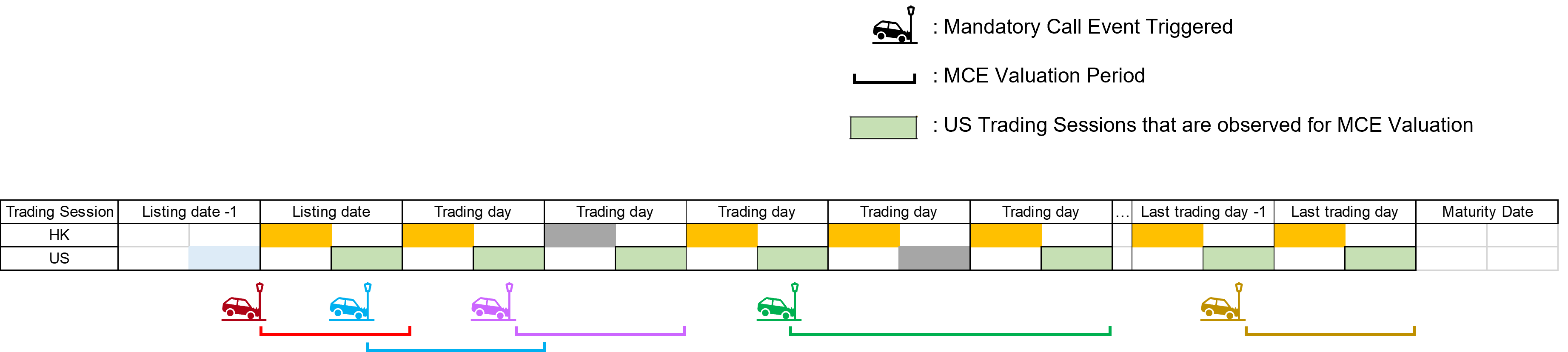

MCE Valuation Period: Immediately after the MCE occurs till the end of the next trading session, regardless of holidays in Hong Kong or the United States.

Similar to HSI CBBCs, the Highest spot level and the lowest spot level represents the highest and lowest level during the MCE Valuation Period., the MCE valuation period starts immediately after the MCE till the end of the following US trading session.

For bull contract: If the lowest level is at or lower than the strike price of the bull contract, the Residual Value will be 0.

For bear contract: If the highest level is at or higher than the bear contract, the Residual Value will be 0.

Note: If the CBBC is being called before market opens of the listing date, the closing price of the preceding trading day and the highest price of the index spot of the next trading session for bull contract (the lowest price of the index spot of the next trading session for bear contract).